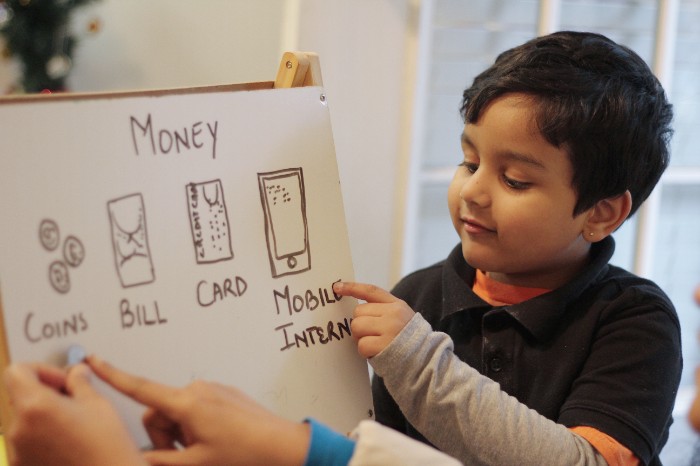

In a world that constantly evolves, preparing our children for the challenges that lie ahead is paramount. One crucial aspect often overlooked is financial literacy. As adults, we understand the value of a dollar, the importance of saving, and the impact of wise financial decisions. But how do we instill these essential life skills in our little ones? The answer lies in teaching kids about money from a young age.

The Power of Piggy Banks

If you’re like most parents, you’ve probably given your child a piggy bank at some point. But have you ever thought about how to teach them about saving money?

Introducing the concept of saving can be as simple as gifting your child a piggy bank. Not only does it make saving tangible and fun, but it also sets the foundation for understanding the value of money. Encourage them to save a portion of their allowance or money they receive as gifts. This teaches patience, delayed gratification, and the joy of watching their savings grow.

As your child’s bank grows over time, expand on the lessons by introducing other concepts related to money. For instance, once your child is able to count change accurately (usually by age 6 or 7), start teaching them how to count bills and coins separately. Then show them how much each coin is worth so they understand why it’s important to keep track of small change instead of just throwing it away!

Budgeting Basics

As kids grow older, involve them in the family budgeting process. Discuss the concept of income, expenses, and the importance of balancing the two. Allow them to suggest ideas for family activities within a budget or involve them in grocery shopping, comparing prices, and making informed choices. This not only imparts practical money management skills but also teaches them the value of making conscious financial decisions.

When it comes to teaching kids about money, make it fun! Discuss how much things cost. For example, when buying groceries with your child help him or her compare prices between brands and sizes of items on sale (if applicable). You can also discuss why some items cost more than others — e.g., why organic produce costs more than conventional produce; why brand name products cost more than generic ones; etc.

The Magic of Earning

Connect chores to earnings by assigning a small allowance for completed tasks. This instills the idea that money is earned through effort and hard work. Consider encouraging entrepreneurial endeavors, like a lemonade stand or a small neighborhood service, to teach them about initiative, responsibility, and the rewards of innovation.

Teach your children the value of giving by helping them donate a portion of their allowance or earnings to charity. It’s important for kids to understand that earning money doesn’t mean keeping all of what you make — it means giving back some of what you receive so others can benefit from it too.

Smart Saving and Investing

Introduce the concept of interest by setting up a mini savings account for your child. Explain how money can grow over time through compound interest. As they get older, discuss basic investment principles in an age-appropriate manner. This early exposure to saving and investing sets the stage for a financially secure future.

Explain the difference between wants and needs. Kids need food, shelter, clothing and other basic necessities but many things they want — like toys and games — are not essential to survival. Helping kids understand this distinction helps them focus on what’s truly important when it comes time to make spending decisions later in life.

Teach children how to save money by putting away small amounts regularly instead of waiting until they have a large chunk of cash before saving it all at once. A good rule of thumb is to put aside 20 percent of their income into savings each month so that they’ll eventually have enough money set aside for emergencies or larger purchases like college tuition or a down payment on a car or home someday when they’re older—and hopefully wiser!

Real-Life Experiences

To teach your children about money, you’ll need to take advantage of everyday opportunities to teach financial lessons. When shopping, explain the difference between needs and wants. Allow them to make simple purchase decisions, emphasizing the importance of comparison shopping and making thoughtful choices.

You can also help your child learn about money by talking about what you’re doing with your own finances. For example, if you’re trying to save up for a car loan or mortgage payment, talk about how much time it takes to save up for such a large purchase. If you’ve just received an unexpected tax refund check, share what you’ll do with it — maybe put some into savings or plan on taking a vacation next year.

By incorporating these practices into your child’s upbringing, you’re not just teaching them about money; you’re providing them with valuable life skills. Financial literacy from a young age equips children with the tools they need to make informed decisions, navigate economic challenges, and build a secure future. As parents and educators, let’s strive to empower the next generation to become financially savvy individuals who can confidently manage their resources and thrive in the ever-changing landscape of the modern world.

RUCHI RATHOR Founder & CEO

Payomatix Technologies Pvt. Ltd.

FOUNDER AND INVESTOR | PAYMENTS PROCESSING EXPERT | MERCHANT ACCOUNT SOLUTIONS | WHITE LABELLED PAYMENT GATEWAY | Dreamer, Creator, Achiever, Constantly Evolving

Website Ruchi Rathor: https://ruchirathor.com

Website Healing Heart https://thehealingheart.me/

Instagram https://www.instagram.com/_ruchirathor_/

LinkedIn https://www.linkedin.com/in/ruchirathor12/

Facebook https://www.facebook.com/ruchi.rathor.magnificient

Tumblr https://www.tumblr.com/blog/ruchirathor-thehealingheart

Medium https://medium.com/@ruchirathor_23436